This article introduces the Cephei.Cell library released recently to the Nuget package manager with source in GetHub honouring an promise made to Don Syme many years ago. It demonstrates the efficiency of development of mathematical models in F#

Background

The “Cell Framework” started fifteen years ago as a mechanism to make Monte Carlo simulations execute fast for interactive calculation of Potential and Expected Exposure of derivative {swap, swaption, cap, floor} trades before execution to ensure they were profitable enough to balance the exposure with a CDS trade. Monte Carlo simulation are compute intensive because thousands of alternate scenarios must be calculated for each time-point. With a minor change to use Cells (with asynchronous calculation) for NPV calculation it was possible to halve the time taken to risk a trade. At the time cells implemented a future promise pattern, but it was apparent the speed of overall calculation far outweighed the cost of constructing and scheduling tasks for reasonably expensive operations, and that re-using the cells for further time-points would allow for more operations to be performed in parallel.

The second version replaced the Mutex lock with a “Latch Lock” pattern (used internally by the Oracle RDBMS) where objects are only explicitly locked if there is contention between threads. This version introduced event subscriptions to propagate changes to dependant Cells like a spreadsheet, and a profiling mechanism to identify dependencies without the time (or errors) of defining dependencies in code. This was used for Early Warning of Liquidity risk, where any number of movements in the price of {equity, FX, futures} instruments could trigger action to tighten risk appetite.

The third version combines the Latch-lock with state transition to provide lockless concurrency; eager-steal for waitless calculation on modern multi-core servers; moves history from within Cells to session to remove garbage collection contention; and initialisation-time profiling of closures.

Cell is significantly faster for large complex calculations, where a number of factors can change, are well-suited to streaming price calculation and real-time risk derivation.

Framework or Kernel

The term “Cell Framework” is used because Cephei.Cell is foundation for Cephei.QL that is being updated for .NET 5 to remove Windows/Wine dependency. Cephei uses code generation to wrap underlying C++ quantitative finance functions into higher-level abstracts to allow an Excel addin to be used to define a financial model that can be saved as a functional program directly – Excel becomes an editor for functional code.

While the Cell Framework replicates the promise pattern and the paradigm of spreadsheet cells, it is also a foundation for different way of thinking about software building blocks that extenuates functional relationships between values rather than linear paths of derivation.

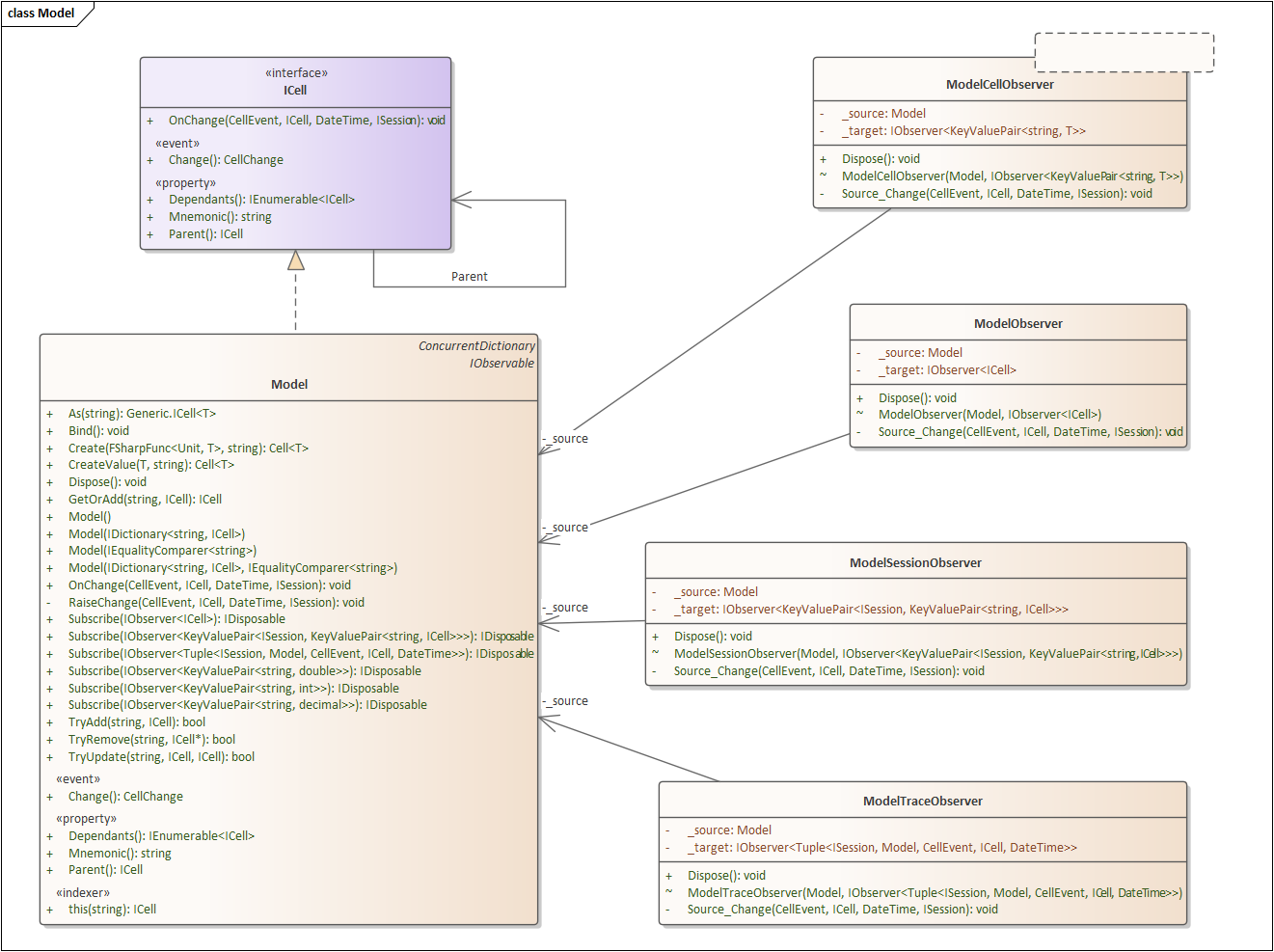

While Cell provides a mechanism to automatically parallel calculate a number of functions, a Model provides a mechanism to encapsulate complexity, and only surface values that are input or output. Model can contain other Models to build high-level abstractions for {Asset-Class agnostic Trade, Portfolio, Book, Ledger, etc}. Cells within a Model can be changed at runtime (like a spreadsheet)

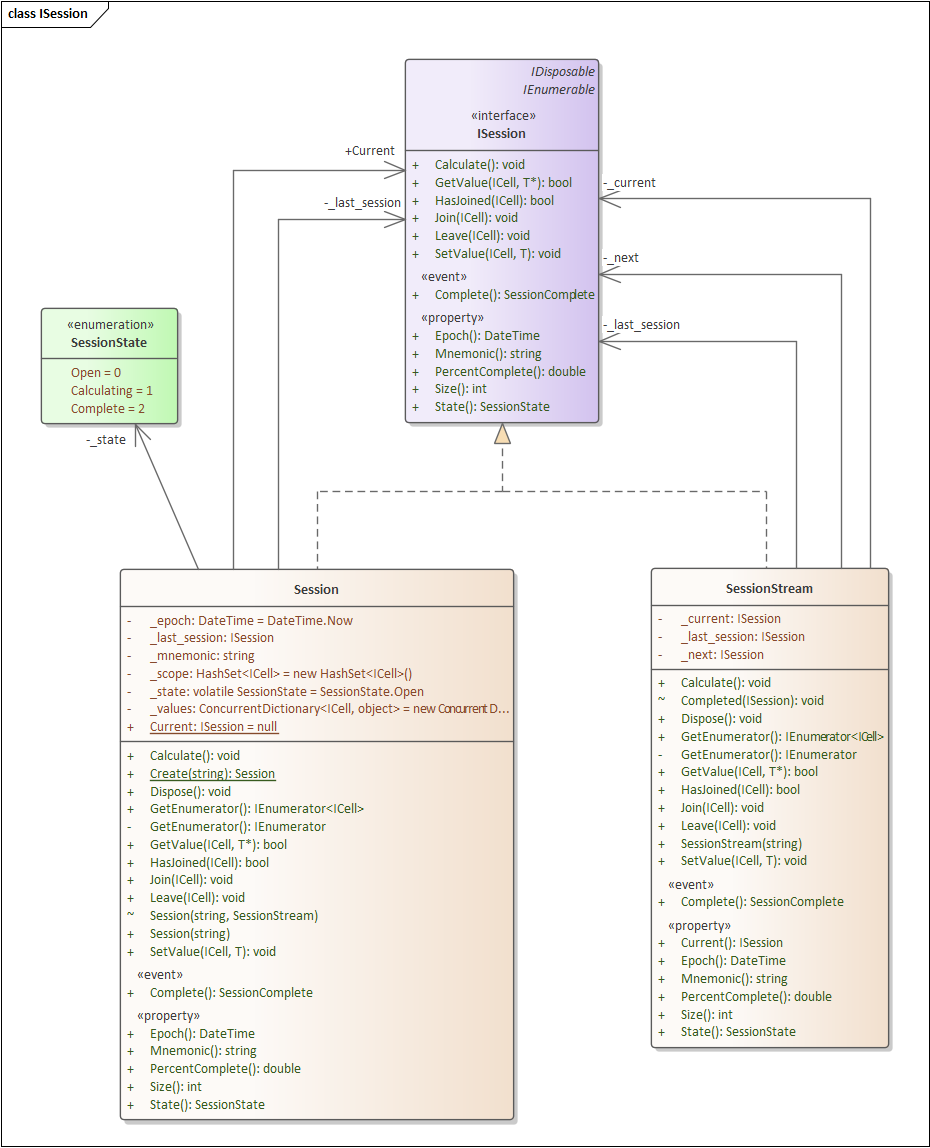

Session provide a mechanism to group together changes to input values (e.g. market data feed) without duplicate calculations (same as the pattern of manual calculation in Excel), while SessionStream adds overlapping sessions for a continuous calculation of high-level values (like RWA) in near-real-time.

Cell and Model provide the IObservable/IObserver pattern for event linkage with a stream based calculation.

Implementation

Cell uses lockless concurrency with thread synchronisation ManualResetEvent for contention (when a value is needed, but calculation has already commenced) using processor cache bypassCompare & Swap for SpinLock and State pointer

Cell

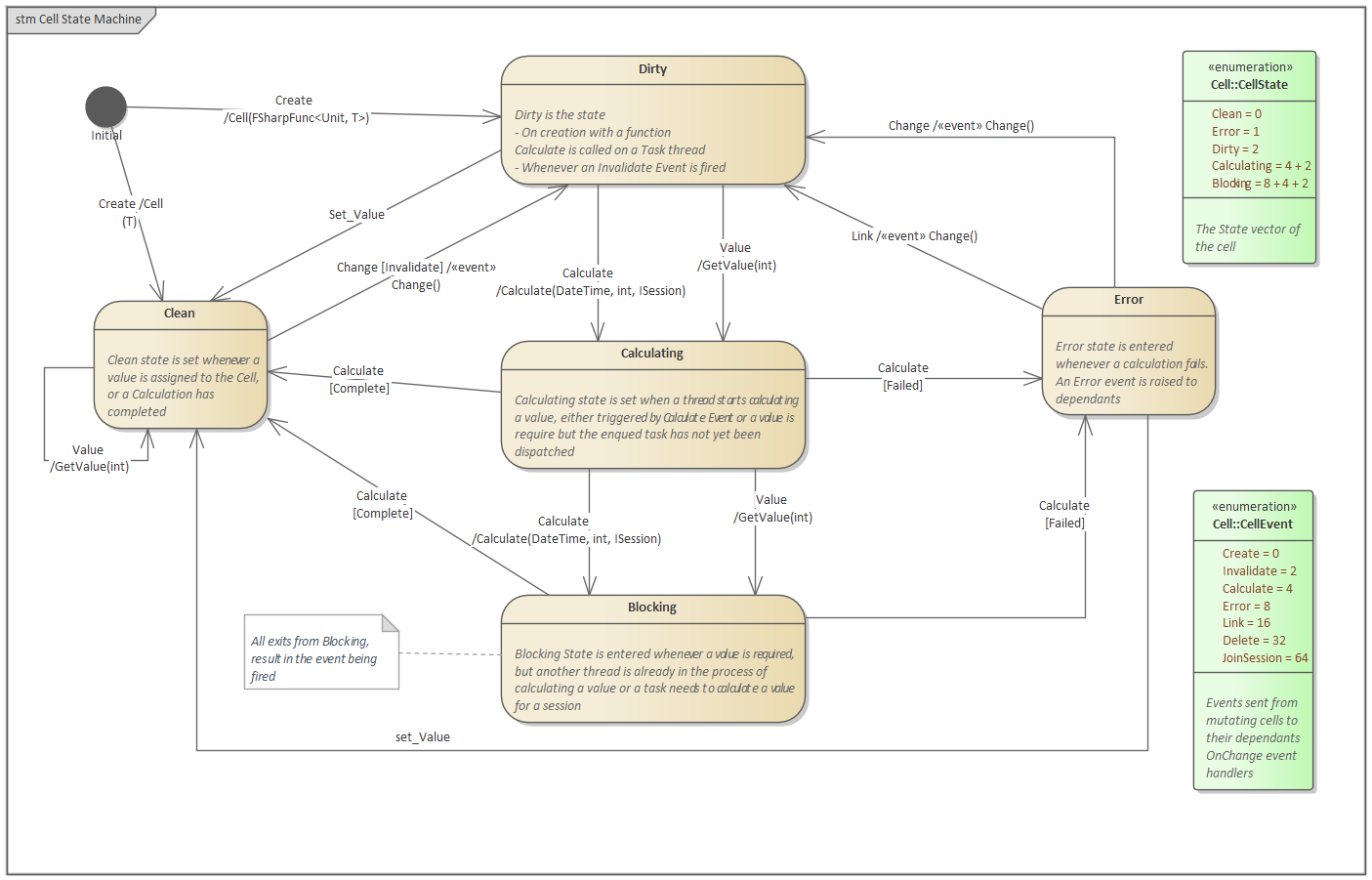

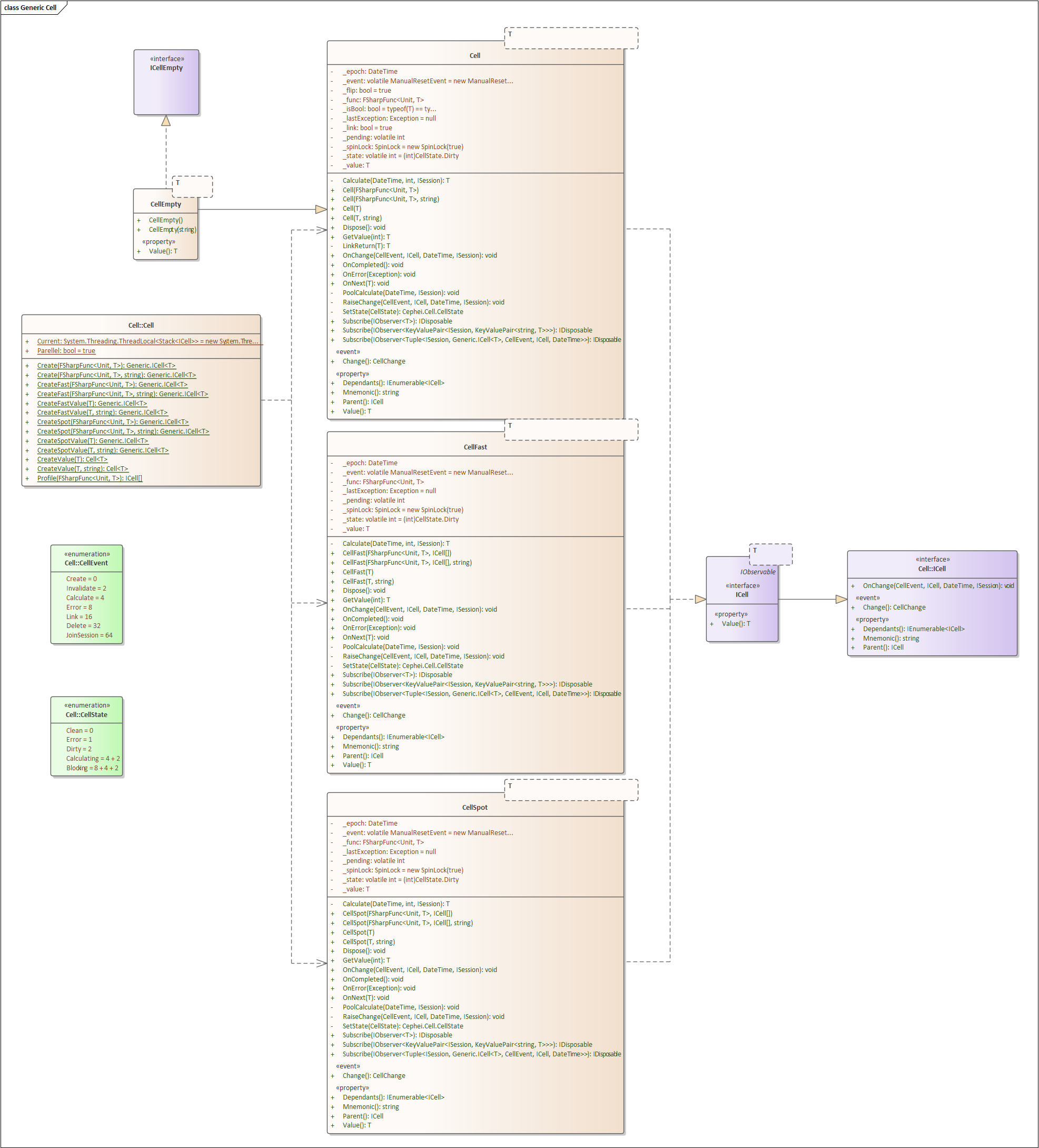

Cell<T> is implemented as a Finite State Machine where Operations and Events cause atomic state-transitions to ensure that under no circumstance is a Dirty value read from Cell, with Operating System Events only used when threads are blocking for a value from calculation currently being performed.

There are three specialisations of Cell<T> that are instantiated either through the Cell module, or (in the case of CellEmpty) through a Model that includes forward-reference to Cells that have not been defined at that point in the Model

CellFast

When it is know in advance that Cells and their references will not be redefined at runtime, and their references are not forward referenced, CellFast<T> can be used to bypass runtime profiling of cells. In this scenario closures are inspected at instantiation to extract the cells that this cell is dependent on.

let calculation_cell =

let build (p : ICell<’t>) =

Cell.CreateFast (fun () -> some_complex_calculation p.Value)

build referenced_cell

In this example referenced_cell is captured by the closure rather than the wider model (Cell.CreateFast factory method should be used to avoid causing the calculation to re-evaluate whenever any value in the Model changes – it will default to a Cell<T> object if there are no parameters for instantiation-time profiling. CellFast<T> should only be used if you are comfortable with advanced concepts of Functional Programming.

CellSpot

CellSpot<T> is a further specialisation of CellFast<T> where it is known in advance that the Cell will never be redefined, and the latest (spot) value should always be used (typically the FX rate for a portfolio)

Cell

The static module Cell provides factory functions to create cells from F# using type-inference, plus a Thread Local stack of Cells currently being profiled.

Any Cell that reads the content of another Cell while evaluating its function, is by definition dependant on it For the Boolean conditional logic, the condition code needs to be in a separate cell in order for the expression to re-profile when the boolean value changes:

let dependant_cell = Cell.Create (fun () ->

if cond_cell.Value then

equity_trade.Value

else

credit_trade.Value)

Model

`Model` provides a tree structured dictionary of cells in an overall model, but is different from a plain dictionary in a number of respects:

`Model` provides a tree structured dictionary of cells in an overall model, but is different from a plain dictionary in a number of respects:

- It collects all events from each of the Cells (& Models) within it, enabling a single subscription for changes to any part of a model

- It provides the

model.As<T>(“reference name”) for type coercion of the value being referenced from different parts of the model, which also enables forward reference of cells that have not been previously defined within a model - Names passed to a model lookup use the

’|’as a delimiter, so “equity|hsbc|lon|fair_value_price” would resolve to a reference to theCellfair_value_price within the hierarchy of the model

Session

`Session` provides for consistency that derived cells are calculated with the same set of values that were set when the session was opened. Generally changes to the spot value of a bond future, with trigger changes to the price of quoted IRS instruments and long-dated government bonds which appear to ripple along a yield curve, which could trigger multiple valuations of dependant instruments – unless relative value arbitrage is being sought, it is better to snap all price changes together and calculate one.

`Session` provides for consistency that derived cells are calculated with the same set of values that were set when the session was opened. Generally changes to the spot value of a bond future, with trigger changes to the price of quoted IRS instruments and long-dated government bonds which appear to ripple along a yield curve, which could trigger multiple valuations of dependant instruments – unless relative value arbitrage is being sought, it is better to snap all price changes together and calculate one.

Session has a Current thread static reference that allows assignment to the value of a cell to be implicitly part of the session, with calculation delayed until the session is disposed – in this content IDisposable.Dispose() is not a euphemism for delete, because the session will be passed through the event-notification methods and kept alive until all Cells have left the session when it finally becomes eligible for garbage collection.

Important values are

- Scope - Cells that have joined the session in response to "JoinSession" event and Join call

- Values - Boxed value of the cells referenced in the session for consistent values

The only guarantee that the value returned from cell.Value will be consistent with the session (later sessions might be scheduled first) is to read the value using a SessionObserver

SessionStream

SessionStream provides a proxy to an interlaced stream of sessions, that return _current for GetValue calls and _next for SetValue moving starting calculation of _next once the _current session has completed.

SessionStream allows an event-stream subscriber to hold a single session open, and allow consistent sets of calculations to be provided as quickly as calculation is completed.

This is designed for real-time-risk where high-level portfolio calculations take time to calculate and can not keep-up with fast-moving-markets. An example would be a liquidity barometer decline in liquidity-coverage-ratio triggers an uptick in internal treasury cross-charging interest rates that have the effect of reducing the risk-appetite and quantity of trades executed.

Usage

The example of a floating rate bond that provides NPV, CleanPrice and DirtyPrice from observations of deposit rates for one-week to one-year and swap rates from two to fifteen years allows the model to be used for

- what-if analysis

- market quotes

- back-testing

- real-time-risk through a simulation model

- liquidity risk All without any changes to the quantitative model. Changing the subscription used to provide deposit and swap rates and adding an onward subscriptions of the NPV, Clean and Dirty prices allows the model to be used for different scenarios

namespace SampleModels

open Cephei.Cell

open Cephei.QL

type FloatingBondModel () as this =

inherit Model ()

(* ... implementation ... *)

// Index model for collection access

do this.Bind()

// Externally visible properties

member this.NPV = NPV

member this.CleanPrice = CleanPrice

member this.DirtyPrice = DirtyPrice

member this.Deposit1W = d1wQuote

member this.Deposit1M = d1mQuote

member this.Deposit3h = d3mQuote

member this.Deposit6M = d6mQuote

member this.Deposit9M = d9mQuote

member this.Deposit1Y = d1yQuote

member this.Swap2Y = s2yQuote

member this.Swap3Y = s3yQuote

member this.Swap5Y = s5yQuote

member this.Swap10Y = s10yQuote

member this.Swap15Y = s15yQuote

The full implementation of the model using Cephei.QL for QuantLib functions demonstrates why F# has been selected as the model scripting language

namespace SampleModels

open Cephei.Cell

open Cephei.QL

type FloatingBondModel () as this =

inherit Model ()

let calendar = Fun.Times.Calendars.TARGET.Create ()

let settlementDate = DateTime (2018, 9, 18)

let fixingDays = 3u

let settlementDays = 3u

let todaysDate = Cell.Create (fun ()-> calendar.Advance (settlementDate, -(int fixingDays), QL.Times.TimeUnitEnum.Days, None, None))

let S = Cell.Create (fun () -> Fun.Swapessions.Create ( todaysDate))

(*

Rate helpers

*)

let zc3mQuote = 0.0096

let zc6mQuote = 0.0145

let zc1yQuote = 0.0194

let zc3mRate = S.With Fun.Quotes.SwapimpleQuote.Create (Some zc3mQuote)

let zc6mRate = Fun.Quotes.SwapimpleQuote.Create (Some zc6mQuote)

let zc1yRate = Fun.Quotes.SwapimpleQuote.Create (Some zc1yQuote)

let zcBondsDayCounter = Fun.Times.Daycounters.Actual365Fixed.Create ()

let months m = Fun.Times.Period.Create (m, QL.Times.TimeUnitEnum.Months)

let ModifiedFollowing = QL.Times.BusinessDayConventionEnum.ModifiedFollowing

let zc3m = Fun.Termstructures.Yield.DepositRateHelper.Create (zc3mRate, (months 3), fixingDays, calendar, ModifiedFollowing, true, zcBondsDayCounter) :> QL.Termstructures.Yield.IRateHelper

let zc6m = Fun.Termstructures.Yield.DepositRateHelper.Create (zc6mRate, (months 6), fixingDays, calendar, ModifiedFollowing, true, zcBondsDayCounter) :> QL.Termstructures.Yield.IRateHelper

let zc1y = Fun.Termstructures.Yield.DepositRateHelper.Create (zc1yRate, (months 12), fixingDays, calendar, ModifiedFollowing, true, zcBondsDayCounter) :> QL.Termstructures.Yield.IRateHelper

let termStrucDayCounter = Fun.Times.Daycounters.ActualActual.Create (Some QL.Times.Daycounters.ActualActual.ConventionEnum.ISDA)

let tolerance = 1.0e-15

(*

Bond Data

*)

let redemption = 100.0

let issueDates = [ DateTime (2015, 3, 15)

; DateTime (2015, 6, 15)

; DateTime (2016, 6, 30)

; DateTime (2012, 11, 15)

; DateTime (1997, 5, 15)

]

let maturities = [ DateTime (2020, 8, 31)

; DateTime (2021, 8, 31)

; DateTime (2023, 8, 31)

; DateTime (2028, 8, 31)

; DateTime (2048, 5, 15)

]

let couponRates = [ 0.02375

; 0.04625

; 0.03125

; 0.04000

; 0.04500

]

let marketQuotes = [ 100.390625

; 106.21875

; 100.59375

; 101.6875

; 102.140625

]

let two2one a b = List.map2 (fun e y -> (e,y)) a b

let combine = two2one (two2one issueDates maturities) (two2one couponRates marketQuotes)

let quote = List.map (fun q -> Fun.Quotes.SwapimpleQuote.Create (Some q)) marketQuotes

let quoteRate r = Fun.Quotes.SwapimpleQuote.Create (Some r)

let usCalendar = Fun.Times.Calendars.UnitedStates.Create (Some QL.Times.Calendars.UnitedStates.MarketEnum.GovernmentBond)

let unadjusted = QL.Times.BusinessDayConventionEnum.Unadjusted

let backward = QL.Times.DateGeneration.RuleEnum.Backward

let semiannual = Fun.Times.Period.Create (QL.Times.FrequencyEnum.Swapemiannual)

let schedule i m = Fun.Times.Swapchedule.Create (i, m, semiannual, usCalendar, unadjusted, unadjusted, backward, false, None, None)

let coupons q = Fun.Doubles.CreateVector ([q])

let actualActualBond = Fun.Times.Daycounters.ActualActual.Create (Some QL.Times.Daycounters.ActualActual.ConventionEnum.Bond)

let fixedHelper q s c i = Fun.Termstructures.Yield.FixedRateBondHelper.Create (q, settlementDays, redemption, s, c, actualActualBond, Some unadjusted, Some redemption, Some i) :> QL.Termstructures.Yield.IRateHelper

let schedules = List.map2 schedule issueDates maturities

let rateHelpers = List.map (fun ((i,m),(c,q))-> fixedHelper (quoteRate q) (schedule i m) (coupons c) i) combine

let bondInstruments = Fun.Vector ([zc3m;zc6m;zc1y] @ rateHelpers)

let bondTermStructure = Fun.Termstructures.Yield.PiecewiseYieldCurveDiscountLogLinear.Create (settlementDate, bondInstruments, termStrucDayCounter, tolerance)

(*

curve building

*)

// Building of the Libor forecasting curve

// deposits

let d1wQuote = Cell.CreateValue 0.043375

let d1mQuote = Cell.CreateValue 0.031875

let d3mQuote = Cell.CreateValue 0.0320375

let d6mQuote = Cell.CreateValue 0.03385

let d9mQuote = Cell.CreateValue 0.0338125

let d1yQuote = Cell.CreateValue 0.0335125

// swaps

let s2yQuote = Cell.CreateValue 0.0295

let s3yQuote = Cell.CreateValue 0.0323

let s5yQuote = Cell.CreateValue 0.0359

let s10yQuote = Cell.CreateValue 0.0412

let s15yQuote = Cell.CreateValue 0.0433

// SimpleQuote stores a value which can be manually changed;

// other Quote subclasses could read the value from a database

// or some kind of data feed.

// deposits

let d1wRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d1wQuote.Value))

let d1mRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d1mQuote.Value))

let d3mRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d3mQuote.Value))

let d6mRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d6mQuote.Value))

let d9mRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d9mQuote.Value))

let d1yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some d1yQuote.Value))

// swaps

let s2yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some s2yQuote.Value))

let s3yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some s3yQuote.Value))

let s5yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some s5yQuote.Value))

let s10yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some s10yQuote.Value))

let s15yRate = Cell.Create (fun () -> Fun.Quotes.SwapimpleQuote.Create (Some s15yQuote.Value))

let depositDayCounter = Fun.Times.Daycounters.Actual360.Create ()

let period n t = match t with

| 'w' -> Fun.Times.Period.Create (n, QL.Times.TimeUnitEnum.Weeks)

| 'm' -> Fun.Times.Period.Create (n, QL.Times.TimeUnitEnum.Months)

| 'y' -> Fun.Times.Period.Create (n, QL.Times.TimeUnitEnum.Years)

| 'd' -> Fun.Times.Period.Create (n, QL.Times.TimeUnitEnum.Days)

| _ -> raise (new Exception ("invalid period type"))

let d1w = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d1wRate.Value, (period 1 'w'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

let d1m = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d1mRate.Value, (period 1 'm'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

let d3m = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d3mRate.Value, (period 3 'm'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

let d6m = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d1wRate.Value, (period 6 'm'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

let d9m = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d9mRate.Value, (period 9 'm'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

let d1y = Cell.Create (fun () -> Fun.Termstructures.Yield.DepositRateHelper.Create (d1yRate.Value, (period 1 'y'), fixingDays, calendar, ModifiedFollowing, true, depositDayCounter))

// setup swaps

let annual = Cell.Create (fun () -> QL.Times.FrequencyEnum.Annual))

let thirty360European = Cell.Create (fun () -> Fun.Times.Daycounters.Thirty360.Create (Some QL.Times.Daycounters.Thirty360.ConventionEnum.European))

let forwardStart = Cell.Create (fun () -> period 1 'd')

let swFloatingLegIndex = Cell.Create (fun () -> Fun.Indexes.Ibor.Euribor.Create (period 6 'm'))

let s2y = Cell.Create (fun () -> Fun.Termstructures.Yield.SwapwapRateHelper.Create (s2yRate.Value, (period 2 'y'), calendar, annual, unadjusted, thirty360European, swFloatingLegIndex, None, Some forwardStart, None))

let s3y = Cell.Create (fun () -> Fun.Termstructures.Yield.SwapwapRateHelper.Create (s3yRate.Value, (period 3 'y'), calendar, annual, unadjusted, thirty360European, swFloatingLegIndex, None, Some forwardStart, None))

let s5y = Cell.Create (fun () -> Fun.Termstructures.Yield.SwapwapRateHelper.Create (s5yRate.Value, (period 5 'y'), calendar, annual, unadjusted, thirty360European, swFloatingLegIndex, None, Some forwardStart, None))

let s10y = Cell.Create (fun () -> Fun.Termstructures.Yield.SwapwapRateHelper.Create (s10yRate.Value, (period 10 'y'), calendar, annual, unadjusted, thirty360European, swFloatingLegIndex, None, Some forwardStart, None))

let s15y = Cell.Create (fun () -> Fun.Termstructures.Yield.SwapwapRateHelper.Create (s15yRate.Value, (period 15 'y'), calendar, annual, unadjusted, thirty360European, swFloatingLegIndex, None, Some forwardStart, None))

(*

Curve building

*)

let tr p : QL.Termstructures.Yield.IRateHelper = p :> QL.Termstructures.Yield.IRateHelper

let depoSwapInstruments = Cell.Create (fun () -> Fun.Vector ([tr d1w.Value; tr d1m.Value;tr d3m.Value;tr d6m.Value;tr d9m.Value;tr d1y.Value;tr s2y.Value;tr s3y.Value;tr s5y.Value;tr s10y.Value;tr s15y.Value]))

let depoSwapTermStructure = Cell.Create (fun () -> Fun.Termstructures.Yield.PiecewiseYieldCurveDiscountLogLinear.Create (settlementDate, depoSwapInstruments.Value, termStrucDayCounter, tolerance))

(*

Bonds to be priced

*)

let faceAmount = 100.0

let bondEngine = Fun.Pricingengines.Bond.DiscountingBondEngine.Create(Some (bondTermStructure :> QL.Termstructures.IYieldTermStructure), None)

let following = QL.Times.BusinessDayConventionEnum.Following

// Floating rate bond (3M USD Libor + 0.1%)

// Should and will be priced on another curve later...

let libor3m = Cell.Create (fun () ->

let t = Fun.Indexes.Ibor.USDLibor.Create ((period 3 'm'), Some (depoSwapTermStructure.Value :> QL.Termstructures.IYieldTermStructure))

t.AddFixing (new DateTime(2028,07,17), 0.0278625, None) :?> QL.Indexes.IIborIndex)

let quarterly = Fun.Times.Period.Create (QL.Times.FrequencyEnum.Quarterly)

let usNYSE = Fun.Times.Calendars.UnitedStates.Create (Some QL.Times.Calendars.UnitedStates.MarketEnum.NYSE)

let floatingBondSchedule = Fun.Times.Swapchedule.Create (DateTime(2015,10,21), DateTime(2020,10,21), quarterly, usNYSE, unadjusted, unadjusted, QL.Times.DateGeneration.RuleEnum.Backward, true, None, None)

// Coupon pricers

let pricer = Fun.Cashflows.BlackIborCouponPricer.Create (None)

let volatility = 0.0

let Actual365Fixed = Fun.Times.Daycounters.Actual365Fixed.Create ();

let vol = Fun.Termstructures.Volatility.Optionlet.ConstantOptionletVolatility.Create (settlementDate, calendar, ModifiedFollowing,volatility, Actual365Fixed)

//use fluent interface to set capvol

let capletPricer = pricer.SwapetCapletVolatility (Some (vol :> QL.Termstructures.Volatility.Optionlet.IOptionletVolatilityStructure))

let floatingRateBond = Cell.Create (fun () -> Fun.Instruments.Bonds.FloatingRateBond.Create (capletPricer, settlementDays, faceAmount, floatingBondSchedule, libor3m.Value, depositDayCounter, Some ModifiedFollowing, Some 2u, Some (coupons 1.0), Some (coupons 0.001), None, None, Some true, Some faceAmount, Some (DateTime(2015, 10, 21)), bondEngine))

let NPV = Cell.Create (fun () -> floatingRateBond.Value.NPV)

let CleanPrice = Cell.Create (fun () -> floatingRateBond.Value.CleanPrice())

let DirtyPrice = Cell.Create (fun () -> floatingRateBond.Value.DirtyPrice())

// Index model for collection access

do this.Bind()

// Externally visible properties

member this.NPV = NPV

member this.CleanPrice = CleanPrice

member this.DirtyPrice = DirtyPrice

member this.Deposit1W = d1wQuote

member this.Deposit1M = d1mQuote

member this.Deposit3h = d3mQuote

member this.Deposit6M = d6mQuote

member this.Deposit9M = d9mQuote

member this.Deposit1Y = d1yQuote

member this.Swap2Y = s2yQuote

member this.Swap3Y = s3yQuote

member this.Swap5Y = s5yQuote

member this.Swap10Y = s10yQuote

member this.Swap15Y = s15yQuote